Effective Money Saving Tips to Boost Your Financial Health

Discover practical money saving tips and strategies to improve your finances and build wealth effectively.

Money Saving Tips: Practical Strategies to Improve Your Finances

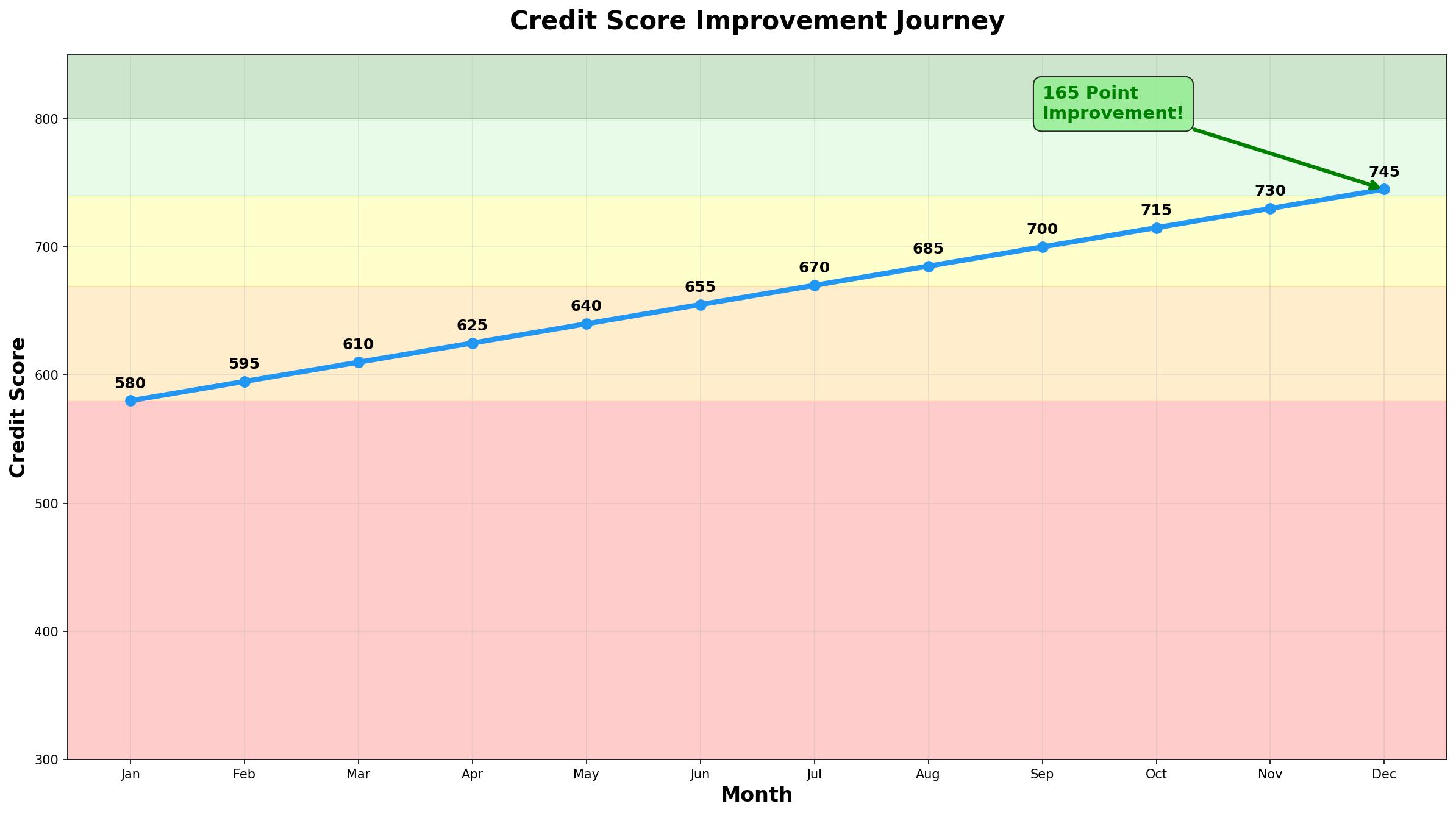

Saving money is a fundamental step towards financial security and wealth building. Whether you're looking to build an emergency fund, pay off debt, or save for a big purchase, adopting smart money saving habits can make a significant difference. This comprehensive guide will provide actionable, practical, and educational money saving tips to help you take control of your finances.

---

Why Saving Money Matters

Before diving into the tips, it’s important to understand why saving money is essential:

- Financial Security: Savings act as a buffer during emergencies like medical bills or job loss.

- Debt Reduction: Having savings helps avoid relying on high-interest debt.

- Goal Achievement: Whether it’s buying a home, traveling, or retirement, savings make these goals attainable.

---

1. Create a Realistic Budget

A budget is the foundation of effective money management and saving.

How to Start:

- Track your income and expenses for one month.

- Categorize expenses: fixed (rent, utilities) and variable (entertainment, dining).

- Set spending limits for each category.

- Use budgeting apps like Mint, YNAB, or EveryDollar.

Example:

If you earn $3,000/month, allocate $1,500 for essentials, $500 for discretionary spending, and aim to save at least $500.

---

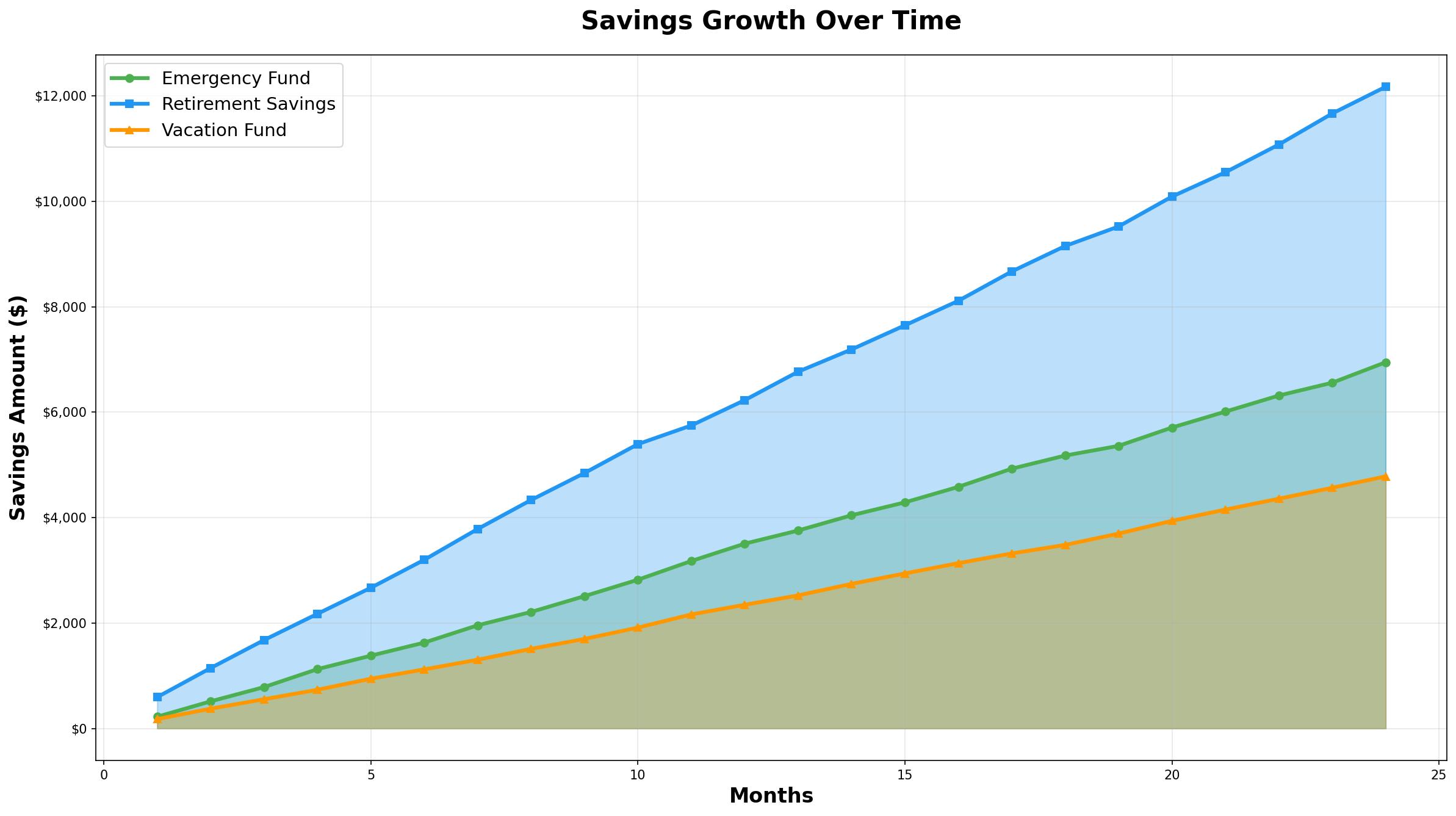

2. Automate Your Savings

Automating your savings ensures consistency and removes the temptation to spend.

How to Implement:

- Set up automatic transfers from your checking to savings account right after payday.

- Use apps like Digit or Qapital that automate small savings based on your spending habits.

Benefit:

You save without thinking, making it easier to build your savings effortlessly.

---

3. Cut Unnecessary Expenses

Review your spending habits to identify areas where you can reduce costs.

Common Areas to Trim:

- Subscriptions: Cancel unused streaming, gym, or magazine subscriptions.

- Dining Out: Cook meals at home more often.

- Impulse Purchases: Wait 24 hours before buying non-essential items.

Strategy:

Use the 30-day rule: If you want something, wait 30 days. Often, the urge will fade.

---

4. Shop Smart

Saving money doesn't mean sacrificing quality but being strategic about purchases.

Tips:

- Compare prices online before buying.

- Use cashback and coupon apps like Honey or Rakuten.

- Buy in bulk for non-perishable items.

- Shop during sales events like Black Friday or end-of-season clearances.

Example:

Buying a $50 item on a 20% off sale plus 5% cashback effectively reduces the cost to $38.

---

5. Reduce Utility Bills

Utility bills can be a significant monthly expense.

Ways to Save:

- Switch to energy-efficient bulbs and appliances.

- Unplug electronics when not in use.

- Lower thermostat settings in winter and raise in summer.

- Use programmable thermostats to optimize heating/cooling.

Example:

Lowering your thermostat by 2 degrees can save up to 10% on heating bills.

---

6. Build an Emergency Fund

An emergency fund prevents financial setbacks from turning into debt.

How to Build:

- Aim for 3-6 months’ worth of essential expenses.

- Start small, even $50 per paycheck helps.

- Keep the fund in a high-yield savings account for easy access and better returns.

---

7. Use Cash Envelopes for Discretionary Spending

The cash envelope system helps control spending by limiting available funds.

How It Works:

- Withdraw monthly discretionary spending in cash.

- Divide cash into envelopes labeled for categories (e.g., dining, entertainment).

- When an envelope is empty, no more spending in that category until next month.

---

8. Increase Your Income

While saving is crucial, increasing your income accelerates your financial goals.

Ideas:

- Freelance or take side gigs.

- Sell unused items online.

- Ask for a raise or seek higher-paying opportunities.

Benefit:

Extra income can be directed straight to savings or debt repayment.

---

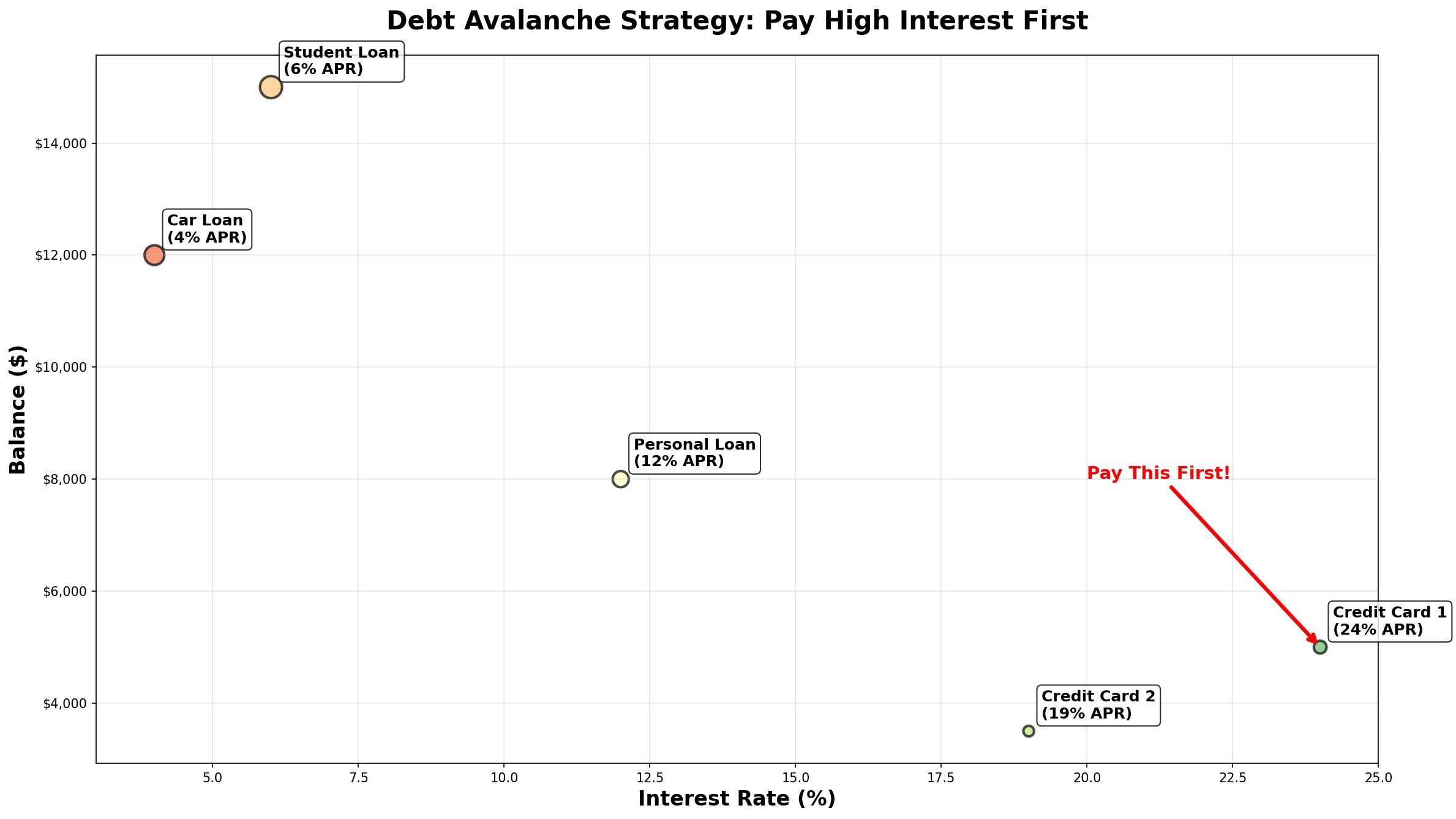

9. Avoid High-Interest Debt

Debt with high interest, like credit cards, erodes your financial progress.

Tips:

- Pay off credit card balances monthly.

- Consider balance transfers to lower-interest cards.

- Avoid payday loans and other predatory lending.

---

10. Set Clear Financial Goals

Having specific goals motivates saving and helps track progress.

SMART Goals Example:

"Save $5,000 for a vacation within 12 months by setting aside $420 monthly."

Track Progress:

Use apps or spreadsheets to monitor your savings milestones.

---

Conclusion

Effective money saving requires a combination of budgeting, smart spending, and disciplined habits. By implementing these practical tips — from creating a realistic budget, automating savings, cutting unnecessary expenses, to setting clear goals — you can improve your financial health and move closer to your financial dreams. Remember, consistency and patience are key. Start small, stay committed, and watch your savings grow.

---

Additional Resources

---

Start saving today and take control of your financial future!