Couples Money Management Tips to Transform Your Financial Future

Discover practical couples money management tips that save, eliminate debt, boost income, and grow wealth together—start today!

Couples Money Management Tips to Transform Your Financial Future

Managing money as a couple can feel like navigating a maze blindfolded. You’re both juggling bills, saving goals, and maybe a mountain of debt, all while trying not to step on each other's toes. If that sounds familiar, you’re not alone.

Why Money Management Is Crucial for Couples

Money disagreements are the number one cause of stress in relationships. According to a 2023 survey by CNBC, nearly 31% of couples cite financial issues as a primary reason for conflict. But here’s the good news: when couples master money management together, they build stronger trust, achieve goals faster, and create a secure future.

Ready to turn your financial chaos into a well-oiled money machine? Here’s your comprehensive, practical guide packed with real examples, actionable steps, and tips you can implement today.

---

Common Money Mistakes Couples Make (And How to Dodge Them)

1. Avoiding the Money Talk

Pretending money problems don’t exist usually makes things worse. Imagine ignoring a leaking roof; the drip turns into a flood.

Fix: Schedule a weekly 30-minute “money date” where you lay out expenses, income, and goals openly.

2. Not Budgeting Together

One partner handles the money alone or both spend independently without a plan.

Fix: Build a shared budget using tools like Mint or You Need A Budget (YNAB), and track it weekly.

3. Ignoring Debt

Debt lurking in the background drains your future wealth and causes tension.

Fix: List all debts with interest rates and create a payoff plan starting with the highest APR.

4. Different Financial Mindsets

One is a saver, the other a spender — leading to frustration.

Fix: Understand each other’s money psychology and find a middle ground. Consider a “fun money” allowance of $100 each per month to spend guilt-free.

---

Step-by-Step Couples Money Management Action Plan

Step 1: Get Transparent

- List all income: Combine salaries, side hustles, investments.

- List all expenses: Fixed (rent, utilities) and variable (groceries, entertainment).

- List debts: Credit cards, student loans, car loans.

Example: Sarah and Mike earn $4,500 and $3,500 monthly, respectively. Their combined income is $8,000.

Step 2: Create a Joint Budget

Use the 50/30/20 rule as a starting point:

- 50% Needs: $4,000 (rent, groceries, utilities)

- 30% Wants: $2,400 (dining out, hobbies)

- 20% Savings/Debt: $1,600 (emergency fund, debt payoff)

Adjust percentages based on goals.

Step 3: Build an Emergency Fund

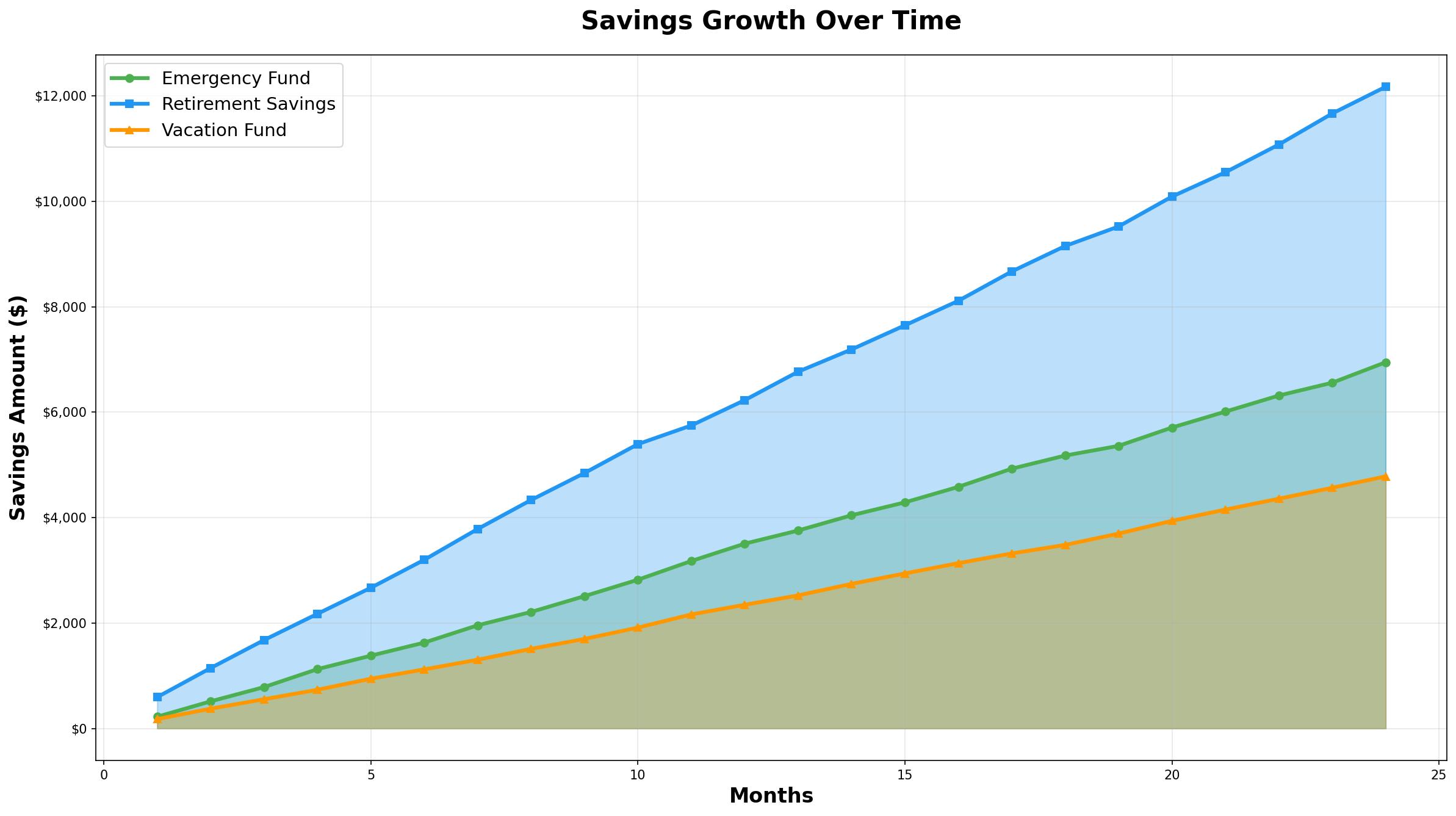

Aim for 3-6 months of expenses. For Sarah and Mike, $4,000 x 3 = $12,000 minimum.

Set up an automatic transfer of $400/month to a high-yield savings account.

Step 4: Attack Debt Strategically

Use the Avalanche Method: Pay off the highest interest debt first to save on interest.

Example: Mike’s credit card at 18% APR with $5,000 balance, Sarah’s student loan at 5% with $15,000.

Put extra $1,000 monthly on Mike’s card while paying minimums on student loan.

Step 5: Improve Credit Together

- Check credit reports for free at AnnualCreditReport.com.

- Dispute errors immediately.

- Keep credit utilization under 30%.

- Pay bills on time.

- Consider becoming authorized users on each other’s credit cards for a boost.

Step 6: Boost Income

- Explore side hustles: freelancing, tutoring, or selling crafts.

- Negotiate raises using salary data from Glassdoor.

- Use cash-back rewards apps like Rakuten for everyday purchases.

Step 7: Start Investing (Even Small)

Open a Roth IRA or joint brokerage account.

Start with $50/month in low-cost index funds (e.g., Vanguard Total Stock Market ETF).

Use robo-advisors like Betterment for hands-off investing.

Step 8: Align Your Financial Goals

- Short term: Save $5,000 for vacation.

- Medium term: Pay off all debt in 24 months.

- Long term: Buy a house in 5 years.

Review and adjust goals quarterly.

---

Real-Life Money Management Example

Couple: Emma and James

- Combined income: $7,000

- Debt: $12,000 credit card, $30,000 student loans

- Monthly expenses: $4,500

Action: They shifted $1,200/month towards credit card payoff, reducing it to zero in 12 months, saving $1,800 in interest. Then, redirected $1,200 to student loans, paying them off 3 years early.

Result: Freed up $1,200 per month to invest, growing a $15,000 portfolio in 2 years.

---

Money Management Tools and Resources

- Budgeting: YNAB, Mint, EveryDollar

- Debt Payoff Calculators: Undebt.it, Bankrate Debt Payoff Calculator

- Credit Monitoring: Credit Karma, Experian

- Investing: Robinhood, Vanguard, Betterment

- Financial Education: NerdWallet, The Balance, Dave Ramsey

---

Troubleshooting Common Couple Money Problems

Problem: One partner overspends secretly.

Solution: Use a shared spending tracker app; set individual discretionary allowances.

Problem: Different risk tolerance in investing.

Solution: Split investments between conservative and aggressive funds, respecting each partner’s comfort.

Problem: Unequal income causes resentment.

Solution: Base contributions to shared expenses on income percentage rather than equal dollar amounts.

---

How Current Economic Trends Impact Couples’ Finances

Inflation pressures groceries and utilities budgets, making budgeting and saving tougher.

Rising interest rates increase borrowing costs — prioritize paying off variable rate debts.

Remote work opportunities can boost income via side gigs.

Stay adaptable and revisit your money plan every 3-6 months.

---

Final Thoughts: Your Next Steps to Money Harmony

Money management as a couple doesn’t have to be a battlefield. With clear communication, shared goals, and a practical plan, you and your partner can turn money stress into financial success.

Start today:

- Schedule your first money date this week.

- Build your joint budget using free tools.

- Pick one debt to attack with extra payments.

- Open a savings account and set up automatic transfers.

Remember, the journey to financial freedom is a marathon, not a sprint. Celebrate small wins, support each other, and watch your financial future brighten.

---

Want more personalized help? Check out our debt payoff calculators and budgeting worksheets linked below to get started now!